Table Of Contents

Why accept crypto payments?

When accepting payments, crypto currencies offer several advantages over traditional fiat currencies.

Cryptos as an asset

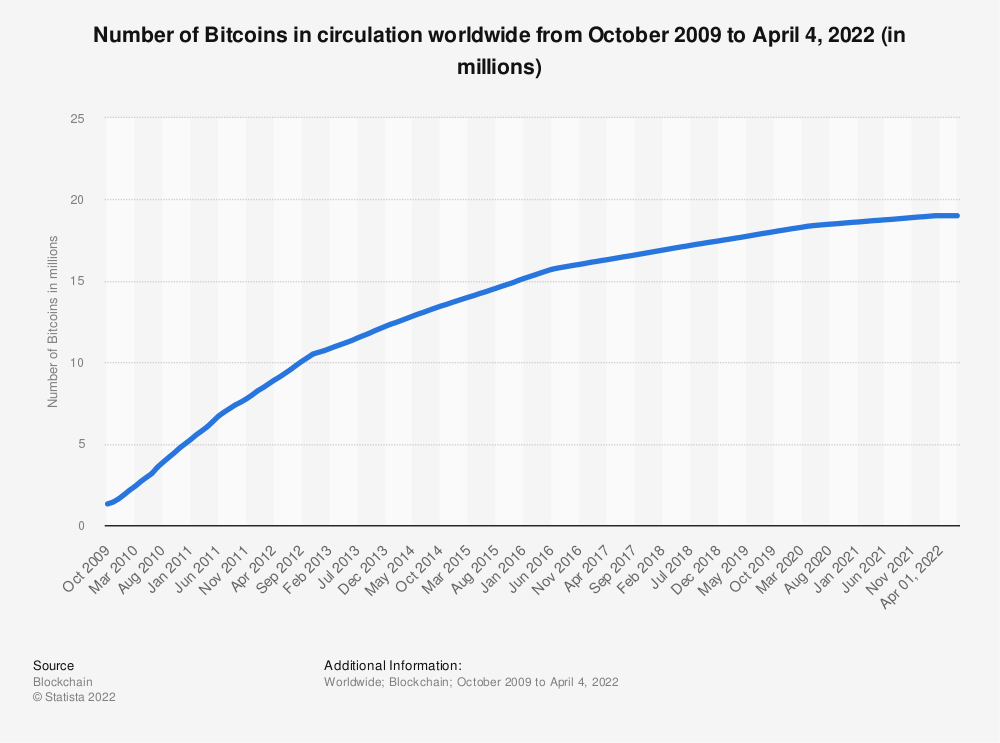

First, crypto currencies are an attractive investment. The value of bitcoin (BTC) has increased 14,000% since November 2015. While the value of BTC and other cryptos have stabilized since the spike in price that occurred in January 2021, BTC is a deflationary asset so we can expect the value to grow over time. The BTC source code sets the cap of BTC in circulation to 21 million, and it’s highly unlikely that this hard cap will change. Thus, cryptos are like silver and gold - they provide a hedge against inflationary fiat currencies.

Cryptos as protection from censorship

Secondly, cryptos offer protection from political interference. Over the last few years, governments have frozen bank accounts of activists, commentators, and protestors. This has occurred in countries that have historically supported strong press and speech freedoms. For example, the Canadian government froze around 200 bank accounts of protesters involved in the trucker convoy. American/NATO led sanctions against Russia has affected an untold number of Russians with little to no ties to Putin. With Western governments leveraging banks and tech platforms to financially punish dissidents, it makes sense to look for alternative ways to transact and store money.

Major crypto exchanges, like Coinbase, have thus far shown to be decent alternatives. It appears that Coinbase and Crypto.com were used as safe havens when Canadian authorities demanded 30 bitcoin wallets to be frozen. Also, major crypto exchanges have released statements opposing sanctions against Russians. However, there is a discrepancy between Coinbase’s statements and its actions. While Coinbase commits to providing services to Russia, it has also blocked 25 thousand BTC wallets, citing concerns over illicit activity. Thus, it is important to remember that whatever major crypto exchanges may say, they are not only beholden to follow the laws of the countries they operate in, but also have a strategic interest to appease political institutions in return for favorable treatment. It’s likely that once crypto exchanges become bigger, they will act more like traditional financial institutions. In that way, they may follow the same path as big tech companies like Facebook, Google, and Twitter. These companies were apolitical during their startup phase. But when they became monolopolies, they served as censors for the American government. This enabled politician to evade first amendment restrictions by having tech platforms using their legal right as a business to moderate content, while providing tech platforms with favorable regulatory treatment.

Here is a real-world example how American politicians can restrict speech online without legal consequences. This example shows how conservatives were affected, but the same strategy can be used for liberals, centrists, or anyone who threatens those in power. In 2019, prominent Democratic politicians called to break up the tech platforms. In 2020 and 2021, these companies increased their attacks on conservative voices. Twitter suspended the NY Post account for sharing a now confirmed story about Hunter Biden’s laptop, Twitter removed then-president Trump from their platform, and Amazon, Google, and Apple deplatformed the conservative-leaning social media sites Parler. After that, Democratic politicians stopped calling Google, Facebook, Amazon, and Twitter monopolies. We maybe a few years away, but it’s likely political powers will threaten the major exchanges with increased government regulations. The exchanges will then be obligated to perform politically motivated actions on their users to avoid regulations. This is one of many reasons why privacy experts avoid centralized exchanges.

Precondition - create your wallet

Before you can accept crypto payments, you need to a wallet to accept transactions and store your crypto. If you already have a wallet, skip this step. There are two major considerations when choosing a wallet:

- What crypto do you want to use?

- Do you want the wallet with an exchange or not?

If you are beginner, I recommend opening an account with a major exchange, like Coinbase, crypto.com, or Binance. They allow users to store and trade the major cryptos and take the complexity out of managing wallets and cryptos. Just create an account and you can start sending, receiving, and trading immediately.

There are drawbacks to using centralized exchanges, however. They charge transaction fees, which can be quite high. Credentials are stored on their servers, so they can be hacked. They all use anti-money laundering (AML) techniques, which means they monitor transactions and can freeze your account if they see funny behavior. Finally, they all follow know your customer (KYC) protocols. That means you need to upload a government-issued photo ID along with personal information. So don’t expect privacy.

Luckily, there are alternatives to centralized exchanges. You can create a wallet on your desktop, which stores the keys on your machine. This is generally much more secure. You can then use decentralized exchanges which have much lower exchange fees and are anonymous. The problem is getting the crypto in the first place. If you just expect to receive crypto directly from your customers or donors, then you’re fine. However, if you want to purchase crypto through a normal back account, you will need to go through a site that has KYC. And since cryptos operate on an open, distributed ledger, once a purchase of crypto is tied to your personal identity then every transaction you make can be tracked (note: monero is the exception to this rule, but it has its own drawbacks).

If you want to purchase crypto anonymously, there are ways. You can find bitcoin ATMs, there are sites that allow you to purchase crypto for cash or prepaid cards, and you can always offer goods and services in exchange for crypto. These approaches are almost always expensive and time-consuming. So if anonymity is vital to you be prepared to pay for it.

Accepting crypto the easy way: QR code/wallet address

The easiest way to get people to send you crypto is to provider your wallet address and/or QR code. See example below:

Monero wallet address:85MKCUp61y5PPjSEW2sKV8h6ZfdBM91oHMMkTj6xHm4mGS8MEfitFanQiToSdCQeGafSwfooz9nvX2eQPYYwa8Px86uzNYQ

Users can then copy your address or take a picture of the QR code, which simply links to the crypto name and wallet address. They can then use send crypto from their wallets directly to yours.

Coinbase Button

Coinbase is the largest crypto exchange, and it offers an easy way to accept payments. These buttons provide a lot convenience, especially to users who are already using these exchanges. They can just sign into their account and send crypto. No fussing with QR codes, wallet addresses, etc. On the user’s end, it looks like this:

This is a much less intimidating interface than a 35-digit wallet address. It also gives users the choice to login to their Coinbase account our send crypto from another wallet if they like.

-

First, you need to create a Coinbase Commerce account.

-

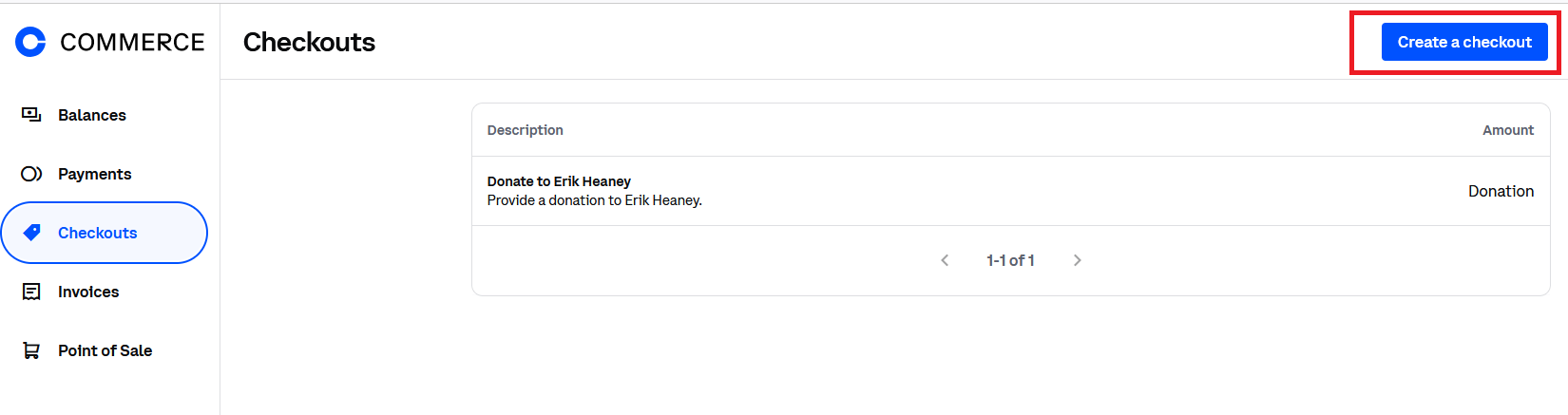

Go to Checkouts > Create a checkout.

-

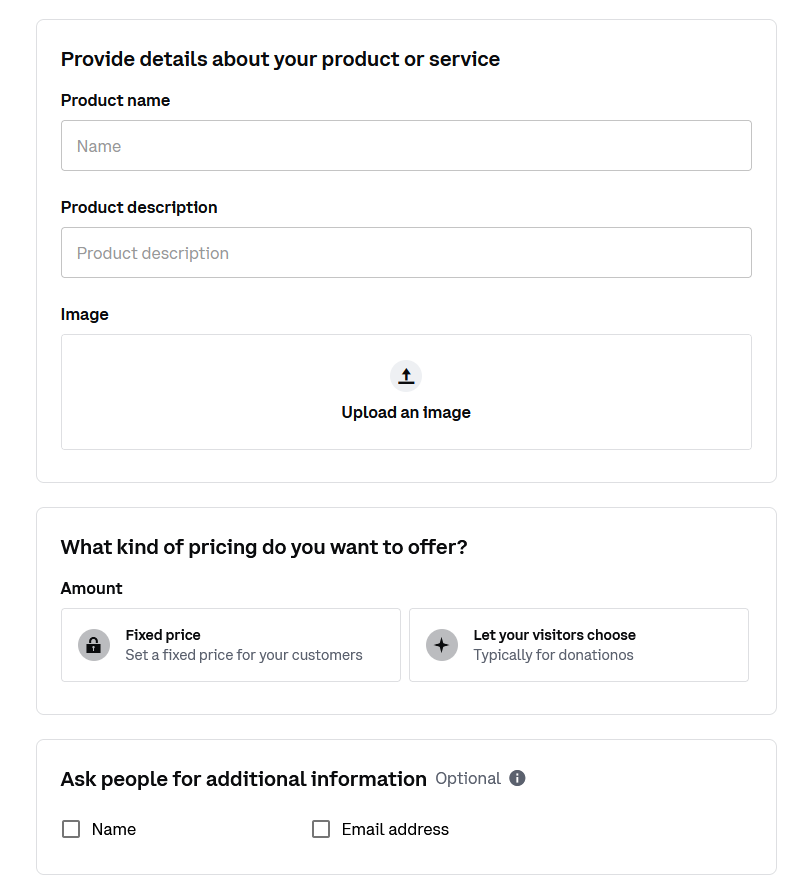

Provide info about the checkout. You can specify info about the payment. You can also set the payment amount or allow the customer to set the amount.

-

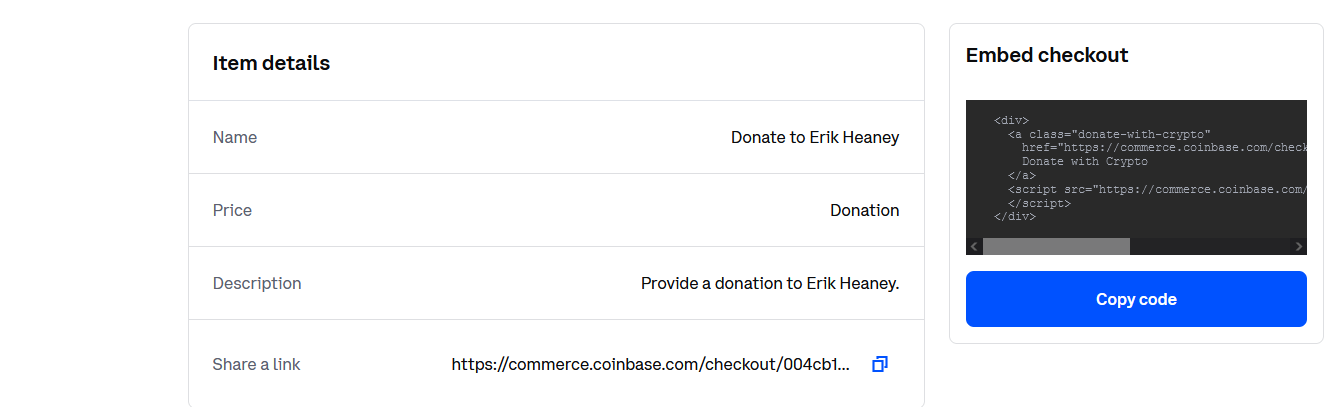

On the checkout page, you should be provided with a link. This link can then be shared with customers, and allow them to pay. There is also HTML snippet to create a button.

Here is the link and button to my checkout:

https://commerce.coinbase.com/checkout/004cb14d-99f4-4671-8c14-1601371ce563

That’s it! Enjoy accepting crypto. There are many other ways of going it, but this will get you started.